Learning how to perform a vertical balance sheet analysis can equip you with the skills to extract actionable insights into your company’s current financial health. To increase the effectiveness of vertical analysis, multiple year’s statements or reports can be compared, and comparative analysis of statements can be done. This analysis makes it easier to compare the financial statements of one company with another and across the companies as one can see the relative proportion of accounts. The business will need to determine which line item they are comparing all items to within that statement and then calculate the percentage makeup. These percentages are considered common-size because they make businesses within industry comparable by taking out fluctuations for size.

- Checking a company’s balance sheet, you’ll likely see the entire assets or liabilities listed as the initial amount.

- It works by listing each line item as a percentage of a base figure within the financial statements in question.

- This approach allows for meaningful comparisons of line items over time or across companies, highlighting changes in the composition and structure of financial statements.

- This is because you can see the relative percentages in relation to the numbers as well as each other.

- The cash flow statement is vital in assessing a company’s ability to generate cash and its cash management practices.

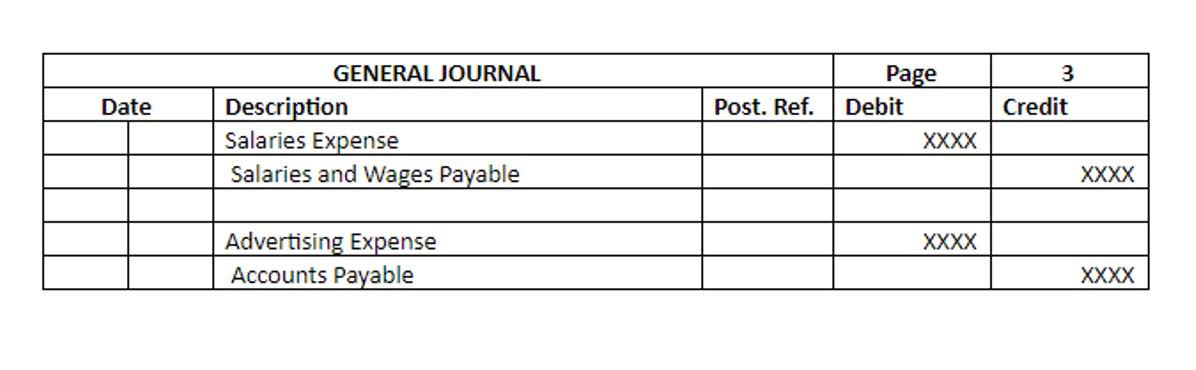

- The first step of vertical analysis is to make a new income statement, such as the common size income statement stated below.

Key Takeaways

While line items on a company’s balance sheet can be listed as a percentage of total assets or liabilities. When you apply vertical analysis to the balance sheet, you can understand the relative composition of assets, liabilities, and equity. Through accounting ratios, you can compare two-line items in your financial statement and point which items are bringing in more profit. By examining the proportional changes in these components, you can evaluate the company’s financial structure, liquidity, and leverage. It helps identify the impact of changes in asset or liability categories on the overall financial health of the organization. Vertical analysis is a powerful technique that allows you to analyze financial statements in a meaningful and comparative way.

Integrating vertical analysis into financial reporting and communication

To deepen your understanding of vertical analysis, let’s explore some practical examples that demonstrate its application in analyzing financial statements. These examples will showcase how vertical analysis can unveil valuable insights and aid in decision-making. Whether you’re an investor, business owner, or financial professional, understanding vertical analysis can help you make informed decisions and identify key trends within financial statements. A vertical analysis, also known as common-size analysis, is a method of financial statement analysis that shows each line item as a percentage of a base figure within the statement. Do you want to take your financial analysis skills to the next level and get more detailed insight into your financial statements?

Step 2: Identify total assets

By analyzing these ratios using https://www.bookstime.com/, you can evaluate a company’s financial position, leverage, and liquidity. Accurate and reliable financial statements are essential for conducting effective vertical analysis. If the financial statements contain errors or are not prepared in accordance with accounting principles, the results of vertical analysis may be misleading.

- For each line item on the balance sheet, divide it by the Total Assets and multiply the result by 100.

- The common-sized accounts of vertical analysis make it possible to compare and contrast numbers of far different magnitudes in a meaningful way.

- They often are used to compare one company to another or to compare a company to other standards, such as industry averages.

- By analyzing the percentages of line items, you can make informed predictions and support strategic planning.

- The same can be done with the income statement, where the previous years can be compared and find out the change in the working capital and fixed assets over time.

- Vertical analysis is a method of financial statement analysis in which each line item is shown as a percentage of the base figure.

It is one of the popular methods of financial statements as it is simple and also called a common size analysis. Vertical common size analysis provides a valuable tool for FP&A professionals to gain insights into the composition, trends, and relationships within a company’s financial statements. Through FP&A tools, you can simplify vertical analysis by conducting faster calculations, incorporating the values into visually appealing charts, forecasting your company’s future through analysing historical data. So, in a vertical analysis of a balance sheet, every line item — cash, accounts receivable, fixed assets, accounts payable, stockholders equity, etc. — is shown as a percentage of total assets. In a vertical analysis of an income statement, every line item is shown as a percentage of gross sales. This method expresses each line item on a financial statement as a percentage of a key benchmark, typically total revenue (in the case of the income statement) or total assets (for the balance sheet).

Horizontal Analysis Vs Vertical Analysis: How To Use Them To Drive Business Success

Common-size financial statements often incorporate comparative financial statements that include columns comparing each line item to a previously reported period. The base amount is often determined by aggregating the results of the financial statements for the same year. After that, the procedure for calculating the common-size fraction may be applied to the monetary item.

The vertical analysis formula is simply dividing each individual figure by your base amount, then multiplying the result by 100. The common size Fraction is also useful for comparing businesses that operate in the same industry but use different currencies or those that operate in a completely different industry. This article defines vertical analysis, describes its process, and provides many trend assessments of current vertical analysis applications.

Evaluate balance sheet composition

For finance and FP&A leaders, it’s a great way to quickly spot any problem areas or parts that need a bit more attention, making their job a bit simpler and more focused. By following these tips, you can enhance the accuracy and effectiveness of your vertical analysis and make informed financial assessments. By leveraging these practical applications, you can harness the power of vertical analysis to enhance financial decision-making and improve overall business performance. Look for items with a significant percentage of Total Assets, as these could represent areas of vulnerability or strength. Read on to learn more about vertical analysis of a balance sheet, how to perform one, and some limitations and drawbacks of this analytical tool.

- The formula to perform vertical analysis on the income statement, assuming the base figure is revenue, is as follows.

- For example, MT saw a 50% accounts receivable increase from the prior year to the current year.

- Do you want to take your financial analysis skills to the next level and get more detailed insight into your financial statements?

- When used together, they offer a comprehensive view of the company’s financial health.

- The above vertical analysis example shows the company’s net profit where we can see the net profit in both amount and percentage.

- In contrast, the process is practically the same for the balance sheet, but there is the added option of using “Total Liabilities” instead of “Total Assets”.